I have been a daughter of an OFW since age 2. One of the earliest conversations with my dad circled around his reasons for not choosing to work locally. And the very first of these reasons was for us to have a decent home and a good life. 3 years into his work as a cashier in Jeddah, he bought a piece of land and 2 years after we moved into our unfinished house. Slowly over the years my mom would try to make major improvements like an extension or a interior finishing or a semi permanent partition which would later on form part of a still unfinished house and lot.

During that time there was no concept of a house and lot development yet at least in our area. So people or OFWs with some savings are left to build or pay some contractor/engineer to work on the house after the lot has been purchased. It takes some time to finish and more often than not because of the small budget, construction is most of the time left unfinished.

This generation of OFWs are the lucky ones. Real estate developers like Camella Homes are now offering built to sell and ready for occupancy units that only need a portion of your savings to jumpstart your dream of owning a home. Reservation is only a fraction of your monthly salary and the terms of payment are so flexible, it allows stretch down payment while they process your bank requirements.

Bank loans are now also very accessible to overseas workers that an OFW bank account is all it takes for a loan approval.

Real estate is still the most efficient way to diversify assets because its value consistently appreciates over time. In the south suburbs, the growth rate in zonal value of land alone has appreciated at an average of 14 percent per annum over the last 10 years alone. It is the only investment aside from fine jewelries that you get to also get to enjoy while it appreciates. And now unlike any other investments, you dont need spot cash to acquire real estate. It truly is better than putting your savings in a bank.

Imagine if you start saving for your intended house and lot now and you peg at least P30k per month as savings to eye your dream house and lot. Yes, you will be able to save a total of P3.6M in 10 years. But unfortunately that same P3.6M property will surely double or triple in 10 years time, minimum of P7M.

And so by that time your money will still not be enough and your bank eligibility will also shorten. So instead of 15 years, you will only be eligible for a 10-year loan. Also, instead of starting early in your 30s, you'd be starting late 10 years post. You would be paying for your property in your old age. And only then will you be able to truly save for retirement.

This is the sad story of most OFWs who thought there is still time for them to save for the house of their dreams. But in reality, and honestly, the best time to save is now and it is through real estate.

So with this blog, all I wanted to do was to bust that myth that says 'Real estate is not a good investment for OFWs, instead buy stocks to earn more money and then buy a property!' This is neither a good concept nor a truthful one, it is infact irresponsible to say the least. The writer, obviously devoid of anything that's sane and moral, is misleading people and OFWs to finding their greedy nature to earn more money.

Real estate may be boring for you Mr Writer. But at least it is safe and guaranteed. Unlike the stock market that can fall out at any time especially in a critical time such as now. The stock market plummetted into oblivion as soon as the first covid19 case was declared in the country. Where is your hard-earned money now, Mr writer? Where are you now?

Real estate may be boring for you Mr Writer. But at least it is safe and guaranteed. Unlike the stock market that can fall out at any time especially in a critical time such as now. The stock market plummetted into oblivion as soon as the first covid19 case was declared in the country. Where is your hard-earned money now, Mr writer? Where are you now?

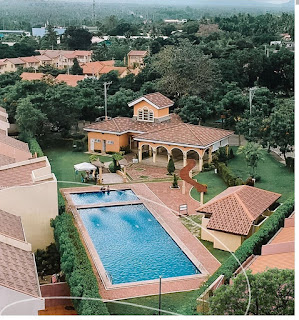

But for those wise investors who have started early like my OFW-wife friend who bought their Camella www.camella.com.ph unit a few years back, they are now living their dream. Already years into their paying period, they are now safely tucked in amidst the crisis, enjoying the convenience of a self-sustained community that is accessible to place of work, school and market with 24/7 security and resort-type amenities.

Another relative startes small with a 1.2M lessandra.com.ph townhouse unit she purchased from Vista and is now almost full paid after less than 5 years . She is now thinking of upgrading to a larger Camella Grande house. The unit she bought 5 years ago had almost doubled and is now 2.2M.

This is how real estate works for you. Enjoy it, live it, love it, buying real estate is truly the best decision you will ever make.

Another relative startes small with a 1.2M lessandra.com.ph townhouse unit she purchased from Vista and is now almost full paid after less than 5 years . She is now thinking of upgrading to a larger Camella Grande house. The unit she bought 5 years ago had almost doubled and is now 2.2M.

This is how real estate works for you. Enjoy it, live it, love it, buying real estate is truly the best decision you will ever make.

Comments

Post a Comment

Thank you for your comments! God bless!