Praise God!!! What an amazing God we have!

Alas! my Sunlife testimony! Sunlife is real!

It was late last year when Jayson Ignacio, my Sunlife Advisor for 4 years followed up on my promise to avail of another policy from Sunlife. My first policy was only a VUL with total disability benefit. I realized then that I needed to have more coverage before I turned 40. I still took sometime to mull over it until I finally made the decision to avail of another VUL and this time with a Critical Illness Benefit rider. It took them about a week to finish the underwriting and by 2nd week of January, I got approval for my policy and paid my first premium.

Fast forward to June 25, 2018. I was rushed to the hospital because of severe chest pain and shortage of breath. I was hooked up with oxygen and was attended to immediately by the emergency staff. They run tests including ECG and right after results came, the doctor took blood samples for the heart attack marker test. After an hour, the doctor informed me that I was having my first heart attack which was confirmed by the marker test. And since my troponin level was 17x the normal elevation, I was immediately sent to the ICU that day.

My IM referred me to a very good cardio doc who explained to me what I was going through. I felt scared for a while and thought of my kids and how they will survive without me. And in my fear, I remembered God’s promises that He will never leave me nor forsake me. It was then that I held on to my faith and found confidence in the Lord God Almighty.

It was also then that I saw God’s love for me through my family and friends especially my Dgroup. They were there to pray for me in the ICU and almost all of them visited me when I was moved to a regular room. It was on my 4th day in the hospital that I remembered my Sunlife policy with CIB. I texted Jayson to ask for assistance and he immediately attended to me and provided me with the list of requirements for submission. He even took time to help arrange for the delivery of the forms to the hospital.

I was finally discharged after about 5 days in the hospital and was given a lot of medications to prevent a second episode. My meds go for about 6k a month so the CIB benefit will really be a great help to me as I continue my medications.

Since my policy was just only 5 months old, it was well within the 2-year contestability period. Sunlife launched a full investigation and went through all my past medical records including that of my records from Medical City where I gave birth to my 3 children.

As months passed by, I was beginning to worry about the approval of my policy but still paid for the next premiums that came.

Jayson helped me with this by religiously following up on the status of my case.

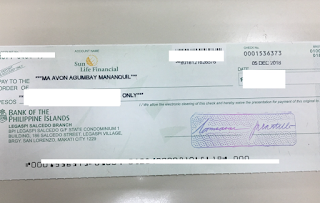

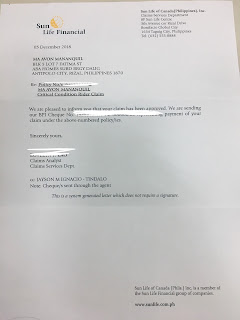

Fast forward to December 4, 2018, got a call from a Sunlife claims officer informing me that my Critical Illness Benefit Rider Claim has finally been approved! She said that Jayson will be the one to pickup the check from Sunlife and give it to me in a week's time. Thank you Lord! Praise God!

Today, December 7, 2018, Jayson happily turned over my CIB check! It was also the first claim in his 4 years of being a Sunlife Advisor. I was indeed a living proof that Sunlife is real. Sunlife pays claims! Thanks to Sunlife I have funds to spend for my full recovery. With upcoming tests and meds, this will truly be a big help to me and my family.

The best thing about this is that my husband also began his journey in Sunlife Last October, he took the Life Insurance license test and passed and is on his way to become a full-pledged Sunlife Advisor in the same group that Jayson is connected. And because of this experience, we are now advocates of Sunlife! To my friends and relatives, please feel free to contact me or Ryan for questions about Sunlife.

I was finally discharged after about 5 days in the hospital and was given a lot of medications to prevent a second episode. My meds go for about 6k a month so the CIB benefit will really be a great help to me as I continue my medications.

Since my policy was just only 5 months old, it was well within the 2-year contestability period. Sunlife launched a full investigation and went through all my past medical records including that of my records from Medical City where I gave birth to my 3 children.

As months passed by, I was beginning to worry about the approval of my policy but still paid for the next premiums that came.

Jayson helped me with this by religiously following up on the status of my case.

Fast forward to December 4, 2018, got a call from a Sunlife claims officer informing me that my Critical Illness Benefit Rider Claim has finally been approved! She said that Jayson will be the one to pickup the check from Sunlife and give it to me in a week's time. Thank you Lord! Praise God!

Today, December 7, 2018, Jayson happily turned over my CIB check! It was also the first claim in his 4 years of being a Sunlife Advisor. I was indeed a living proof that Sunlife is real. Sunlife pays claims! Thanks to Sunlife I have funds to spend for my full recovery. With upcoming tests and meds, this will truly be a big help to me and my family.

The best thing about this is that my husband also began his journey in Sunlife Last October, he took the Life Insurance license test and passed and is on his way to become a full-pledged Sunlife Advisor in the same group that Jayson is connected. And because of this experience, we are now advocates of Sunlife! To my friends and relatives, please feel free to contact me or Ryan for questions about Sunlife.

Comments

Post a Comment

Thank you for your comments! God bless!